Paper Market Update | November 2023

Norske Skog’s Saugbrugs PM 6 Likely to Remain Offline Through H1 2024

Norske Skog will rebuild paper production at its Saugbrugs mill in Norway with the help of insurance money for the damage inflicted on the mill from a rockslide on April 27, 2023. The total insurance settlement is $230 million, with property insurance covering $52 million and the remaining $178 million to be used for production equipment investments. The insurance benefits will enable the company to rebuild PM 6 for the production of SC papers, but also to consider "investment in other product alternatives.” The company expects to have PM 5 back in operation in the fourth quarter of 2023, and PM 6 rebuilt within the next 18 months. The Saugbrugs mill is one of the most efficient producers of supercalendered (SC) paper in Europe. With PM 5 back in operation, the mill has a capacity of 200,000 tons per year.

Billerud Delays Escanaba Boxboard Conversion Project

Billerud decided to postpone its North American transformation investment program “given the changed economic conditions” in the past two years, Billerud acting President and CEO Ivar Vatne said during the company’s third quarter earnings call on Oct. 25. Billerud’s plan included the conversion of its Escanaba, Michigan, printing and writing paper mill to folding boxboard (FBB). The first phase of the project was planned for 2025, and the second phase was planned for 2029, with a total capacity of 1.2 million tons of FBB.

UPM to Permanently Shut Plattling Paper Mill in Germany by End of November

In July, UPM Communication Papers announced plans to permanently close its Plattling mill in Germany to align graphic paper capacity to customer demand. The participation process with the employee representatives has now been completed and the mill will cease its production by the end of November 2023. Graphic paper production on the two machines is expected to end on November 15 (PM 11) and on November 22 (PM 1), reducing the coated and uncoated publication paper capacity by 595,000 tonnes in Europe.

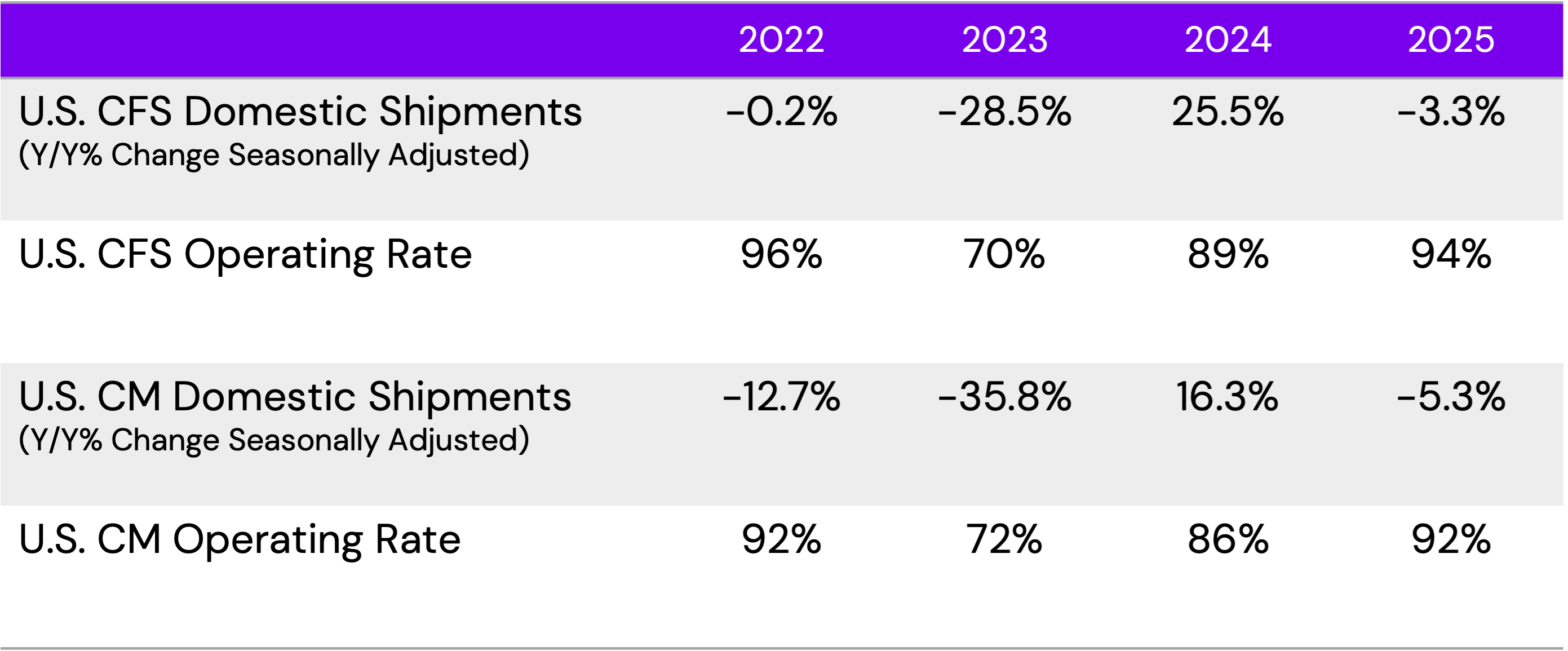

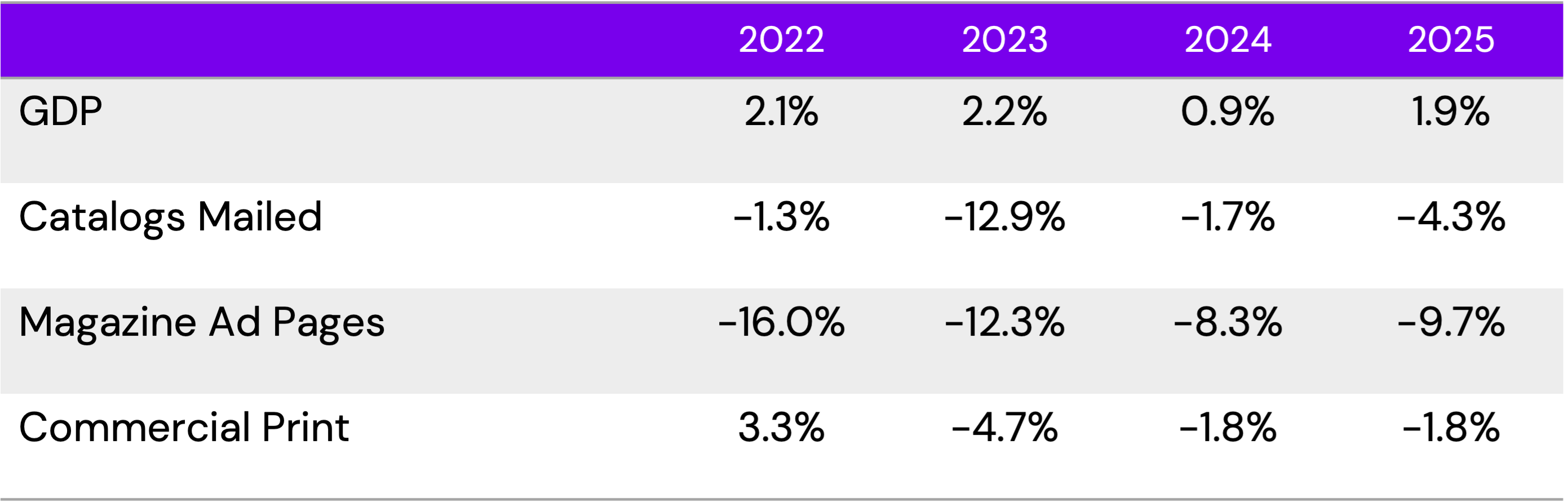

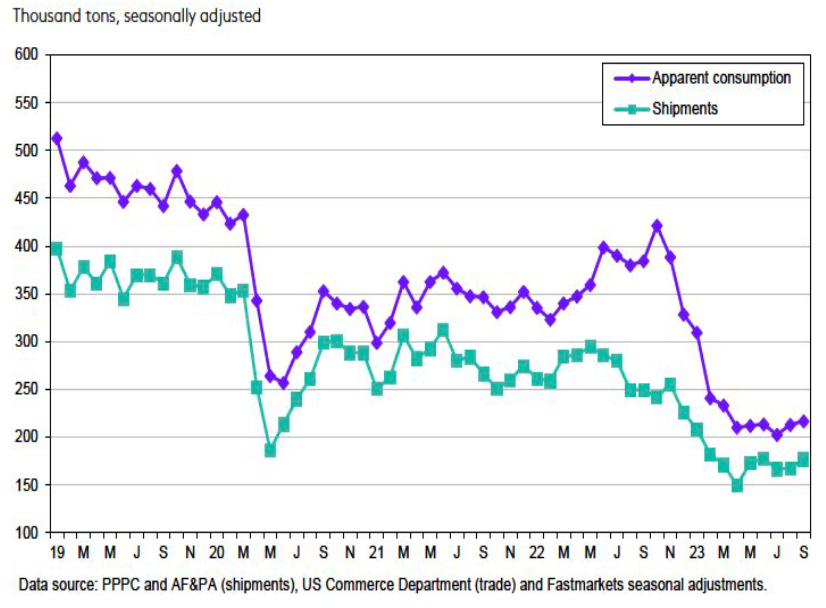

Destocking Continues to Aid the Demand Outlook

Coated paper end uses have not performed nearly as poorly as paper demand, lending support to the narrative that underlying paper demand in 2023 has not been as negative as shipment figures suggest. Magazine ad pages and catalog circulation, while struggling mightily, are down only 12-14% year to date, while the commercial printing industry’s performance was down 4-7% through September. Much of the expected demand recovery could simply come from coated paper shipments and usage coming back into balance as the destocking cycle ends. The 2024 demand recovery will also be supported by increased printing and advertising activity driven by the 2024 U.S. election cycle. (RISI)

Demand and Operating Rate Forecasts (RISI)

U.S. Economy and Paper End-Use Indicators

N.A. Coated Paper Demand & Shipments

N.A. P&W Paper Producer Inventories

-1.webp?width=1050&height=273&name=TSG-CJK-logo-RGB_150dpi_transparent%20(1)-1.webp)